The Financial Services sector aims for universal access to financial services by achieving seamless end-to-end solutions, fully digital payments, advanced interfaces, biometric identification systems and other cutting-edge technologies.

Key messages:

Financial services companies have a unique opportunity to address major societal issues and make new markets, without a significant trade-off in growth or profits. This imperative puts firms in a position to impact almost every corner of the economy, proactively rebuild trust, and transform not just financial services, but also our collective human experience.

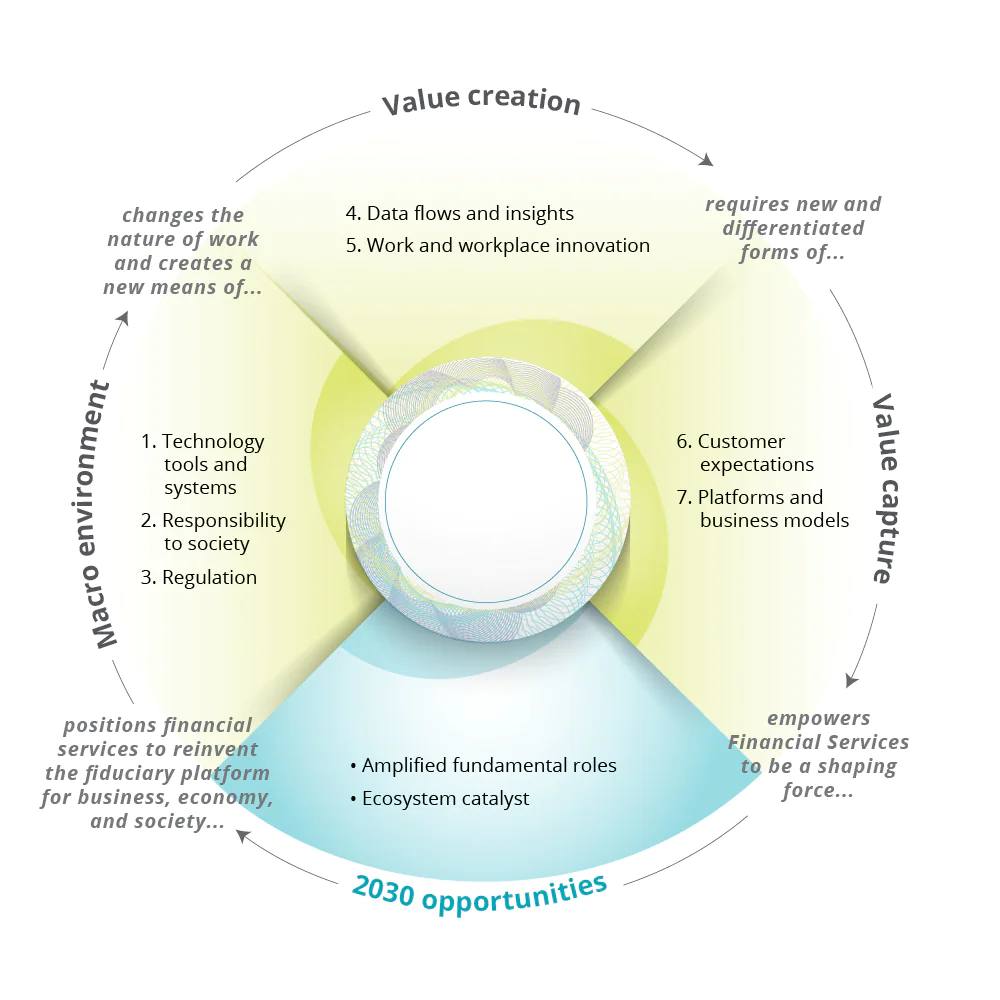

- Seven fundamental forces are working across the broader environment, as well as in the ways value is created and captured, to drive the industry toward 2030. Together, they will build upon each other to amplify the challenges and opportunities ahead. They will also provide industry leaders with the inspiration to act boldly—not just to ensure a prosperous future, but to help shape it.

- As advancing technology expands the quantity and quality of data sources, access to data flows is becoming a critical resource. Firms’ ability to meet customer expectations will hinge on their access to and insights from these ever-increasing flows of data, now the fifth, and perhaps fastest-changing, factor in production. Incumbents will need to reinvent their data strategies to stay competitive, striking a delicate balance between sharing data with alliances and maintaining stringent control over proprietary information.

- As customers become more sophisticated and services more commoditized and disintermediated, they will increasingly act as competitors to financial services players. Customers’ needs and wants will continue to evolve, while new platforms will increasingly allow them to service their own financial needs. Treating customers as stakeholders and delivering on their expectations (particularly those of high-value customers) will put firms in a better position to retain existing customers and attract underserved ones.

- The marketplace of 2030 will be unprecedentedly fluid and interdependent. It will be marked by the continued emergence of new disruptors such as fintechs, digital giants, players from other industries, and even new entrants, each of which have distinct beliefs, strengths, and weaknesses. Innovative business models and alliance ecosystems will be required for incumbents to respond to these dynamics, create new revenue streams, and establish strategic advantage.

- Firms that move early to establish alliance ecosystems will secure significant advantages as they lock in the network effects that many-to-many value webs offer. When it comes to embedding financial services into other customer-centric businesses, firms have an opportunity to build a “financial layer” in the technology stack; nonfinancial brands can then integrate that layer into their products to offer financial services to their customers and build new companies based on it.

Explore what the future looks like and what it means for financial services institutions in the tabs below.

- Macro environment | Technology tools and systems

- Macro environment | Responsibility to society

- Macro environment | Regulation

- Value creation | Data flows and insights

- Value creation | Work and workplace innovation

- Value capture | Customer expectations

- Value capture | Customer expectations

New roles for a new future of financial services

Financial services organizations have historically played a number of fundamental roles in enabling and shaping the modern world.